Save time on payroll processing

Stay in control

Quality assurance

Payroll processing is now fully automated. From start to finish.

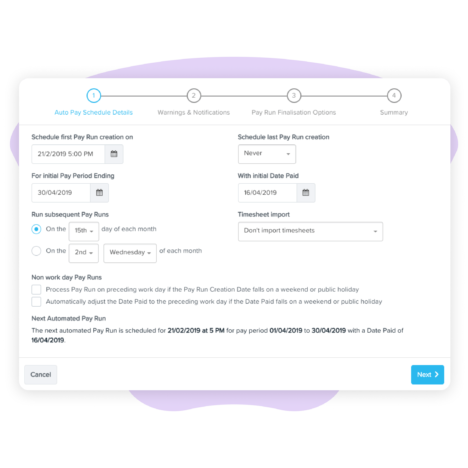

Run multiple pay runs in the background at the same time. Choose which pay run processes to automate, and enjoy greater control by choosing specific dates and times to automate certain tasks.

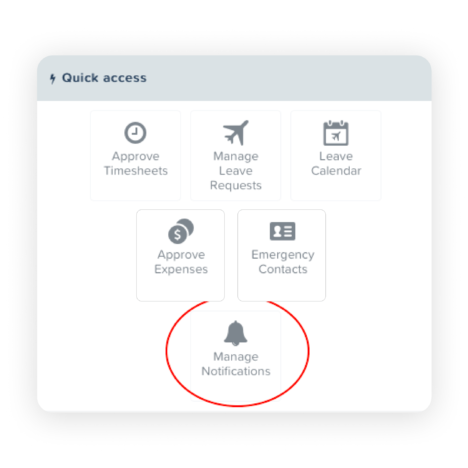

Run payroll on your terms. Choose what you want to get notified about to stop the automation, and who needs to be informed.

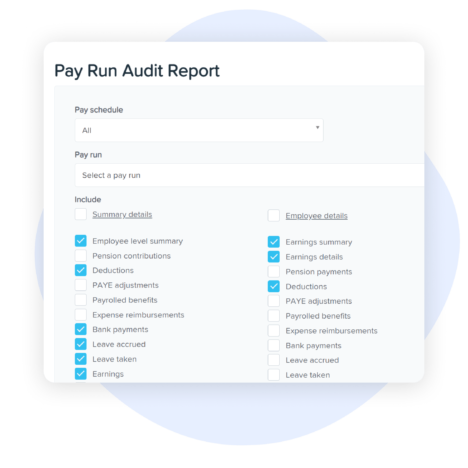

Choose whether to immediately or manually finalise the pay run, and automatically build and send reports on a recurring basis, based on the schedule set. Lodge Annual Income Information via the AIS.

What can you automate?

Payroll and leave calculations

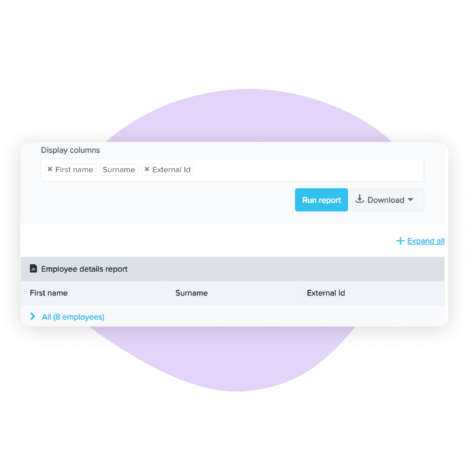

Transference of data across systems

Public holidays

CPF calculations and IRAS submissions

Reporting

Payslips

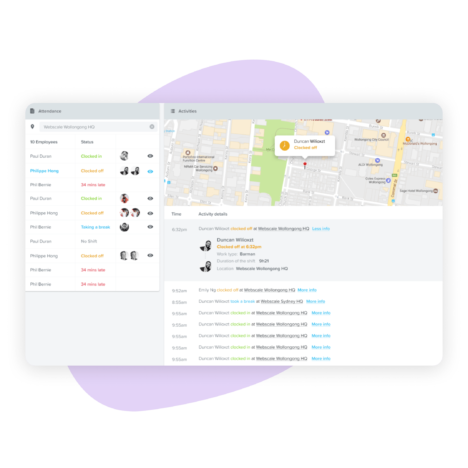

View dates, times, locations and images of each attendance activity recorded via Clock Me In. Cross reference activities against timesheets and rosters to eliminate uncertainty around shifts worked. You can even filter according to different locations, for businesses that operate across multiple venues.

Made by payroll experts. For payroll experts.

Automated payroll systems FAQs

An automated payroll solution uses software to help managers save time by automatically performing payroll tasks, such as payroll calculations, calculating tax withholdings, generating pay slips and paying employees in just a few clicks.

Manual payroll involves calculating employee salaries and taxes using spreadsheets, calculators, paper and other tools.

An automated payroll platform helps to eliminate the need for manual data entry and makes sure employees can easily access their payslips and get paid correctly and on time. This in turn reduces company operating costs while increasing productivity and simplifying the payroll process. Small business owners, accountants and HR teams can focus on more strategic tasks like employee engagement and business growth.

Automated payroll software collects and processes employee and payroll data from multiple platforms, such as integrated time-tracking systems, accounting software, and HR software.

Once a one-off configuration is set, the software then uses this data to calculate employee salaries, wage deductions, and payroll taxes based on local payroll legislation changes, unique employee scenarios and the company’s payroll policies and regulations. Finally, employees are paid straight into their bank accounts, by pay schedule set.

Core payroll tasks such as importing timesheets, calculating pay or sharing payslips can be automated with the help of using cloud based technology.

Cloud-based payroll software like Employment Hero Payroll keeps all employee data in one centralised location and updates in real time. A payroll software with employee self-service also reduces the workload associated with payroll administration. By empowering employees to access and enter their own data and even view their wages, deductions, and benefits, managers will no longer have to chase for data. When using the right cloud payroll system, small business owners, managers and payroll and HR teams can fully automate payroll, as long as one-off configurations have been set.

When looking for an automated payroll service provider, it is important to make sure it is cloud based and has features such as shift management, local compliance with regulations, integration with existing software, employee self-service capability and scalability.

Additionally, you should evaluate the security of the provider’s systems and the support they provide, to ensure that your data is secure and all issues can be addressed quickly.

Innovation, reliability, customer service.

A tick, gold medal, five stars.

over the past year

Resources. All for you.